Wells Fargo Direct Deposit Time

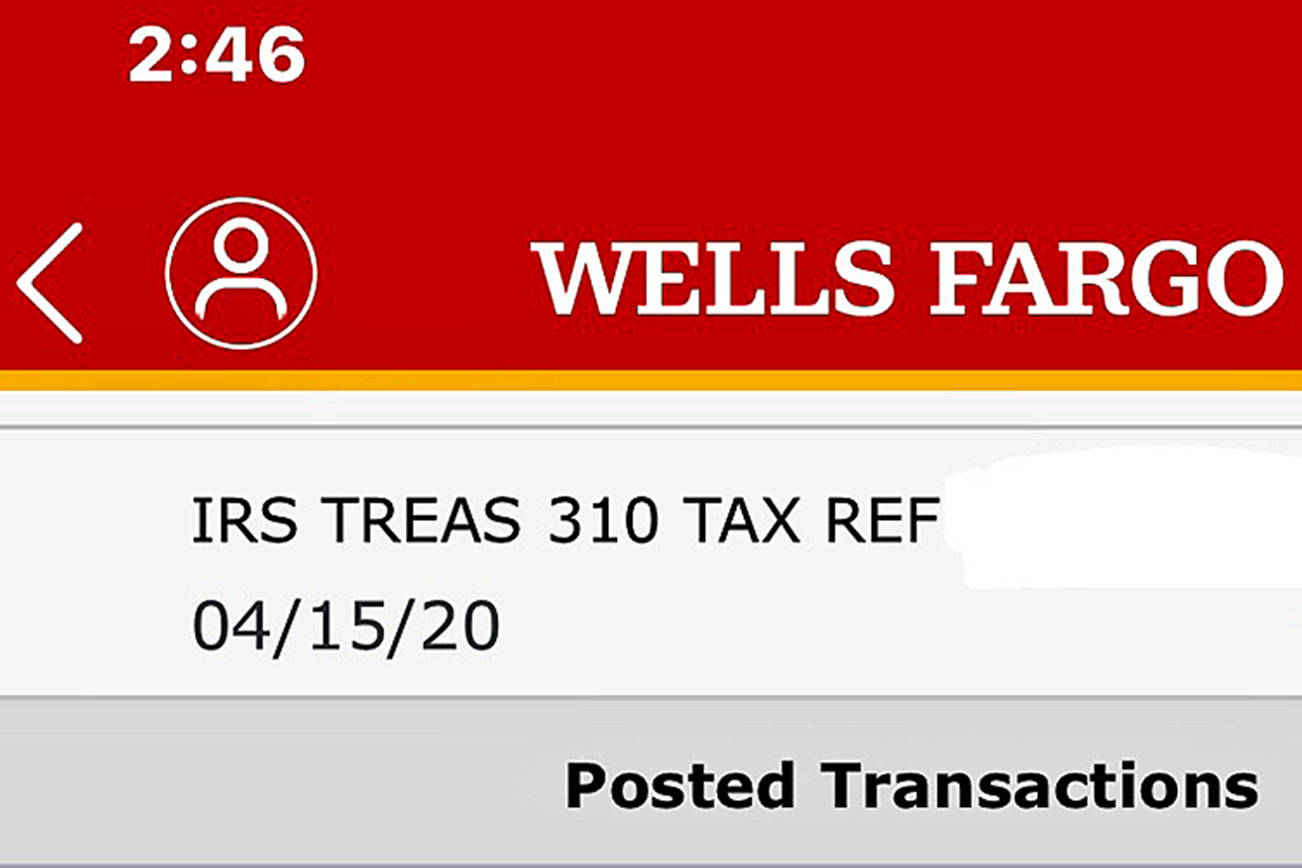

20 minutes ago What time does direct deposit hit wells fargo. How to avoid overdraft fees no matter where you bank If you want the package to get to the destination faster, you need to pay a little more. Wells Fargo customers can make a mobile deposit 2 using the Wells Fargo Mobile ® app or make a deposit at an ATM. The expected time frame for direct deposits to post is between 12 a.m. (EST) on the date your employer sends the deposit (or the date instructed by the sender). Find a SunTrust Bank.

Wells Fargo Bonus Promotions

Credit Card Promotions

- Wells Fargo Cash Wise offers a $150 cash rewards bonus after you spend $500 within the first 3 months. This card earns 1.5% cash rewards on purchases. There is a 0% intro APR for 15 months on purchases and balance transfers. After that, a 14.49% - 24.99% variable APR. Balance transfer fees apply. There is a $0 annual fee.

- Wells Fargo Platinum offers 0% intro APR for 18 months on purchases and balance transfers. After that, a 16.49%-24.49% variable APR. Balance transfer fees apply. There is a $0 annual fee.

Checking Accounts

Wells Fargo frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select cities, so make sure you read the fine print carefully.

Wells Fargo checking accounts offer free mobile banking, account alerts, and free online bill pay. Accessing your money is convenient with free access to over 13,000 ATMs nationwide.

Everyday Checking Account Features

This is Wells Fargo's most popular checking account. It requires a minimum deposit of $25. Here are some unique features:

- Optional Overdraft Protections. Wells Fargo offers a few protection options in cases of accidental over-withdrawal. Overdraft Rewind erases the overdraft if you receive a direct deposit that covers the amount by the next day. You can also link a savings and/or credit account and funds from that account will be used to cover overdrafts. Or when your balance isn't enough, you can choose to go through with the transaction only if you approve it.

- Card-free ATM access. If you need to withdraw money, but forgot your card at home, you can access Wells Fargo ATMs with a code instead. From your Wells Fargo mobile app, you can request a one-time code. Then you'll be able to complete any available ATM transactions. This feature is free.

- Pause lost debit card. If you misplaced your debit card, you can temporarily turn it off so others can't use it. Once you've found it, just simply turn it back on.

- Custom debit card. You can design your debit card to reflect your personal style. You can choose your own photo or one from Well Fargo's image library for your debit card.

There is a $10 monthly service fee, but it can be waived by doing just ONE of the following:

- Make at least 10 posted purchases/payments each month on your debit card

- Have at least $500 each month in qualified direct deposits

- Maintain a $1,500 minimum daily balance

- Link a Wells Fargo Campus ATM or Campus Debit Card

Wells Fargo Direct Deposit Timeline

Direct Deposit is a free service that automatically deposits recurring income into any Wells Fargo checking, savings, or prepaid card account you choose. Income you receive from your employer, Social Security, pension and retirement plans, the Armed Forces, VA Benefits, and annuity or dividend payments may all qualify for Direct Deposit.

Benefits

- It's convenient. Free up some time by having your money automatically deposited into your Wells Fargo account.

- It's fast. You have same-day access to your money on the day of deposit.

- It's safe. Never worry about checks getting lost, delayed, or stolen.

Wells Fargo Direct Deposit Time Central

Customers with Direct Deposit can also take advantage of our automatic Overdraft Rewind® feature. If we receive an electronic direct deposit by 9:00 a.m. local time, the bank will automatically reevaluate transactions from the previous business day and may reverse overdraft or returned item, non-sufficient funds (NSF) decisions, and waive or refund associated fees.

Three easy steps

If the company or agency that pays you offers Direct Deposit, follow these three easy steps to set up Direct Deposit into your Wells Fargo account.

Step 1. Use our pre-filled form

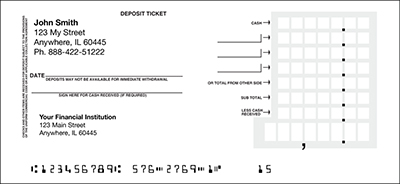

Sign on to Set Up Direct Deposit to create your customized Direct Deposit form. Simply select the account you’d like your deposits to go to, and we’ll pre-fill the form with your routing number, account number, and account type.

Or you can download a blank Direct Deposit Information Form (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you’ll need.

If you have questions about direct deposits from a federal agency, you will find full contact information on the Direct Deposit Information Form, or you can visit a Wells Fargo retail banking branch near you.

Wells Fargo Direct Deposit Time Frame

Step 2. Print your completed form and provide the information to the company or agency that pays you

Your payor may ask you to complete their own form or provide a voided check in order to process your request.

Step 3. Monitor your account

It may be one or two pay or benefit periods before Direct Deposit goes into effect. You can sign up for alerts that notify you when a direct deposit is available in your account. Just sign on to set up alerts.

Wells Fargo Direct Deposit Time Reddit

Questions?

Wells Fargo Direct Deposit Time

We're available 24 hours a day, 7 days a week at 1-800-TO-WELLS(1-800-869-3557).