Deposit Money At Atm

With an ATM Cash Deposit Machine, you no longer have to wait to collect money during your bank’s working hours. You can even deposit cash after the banking hours are over. From the long queues at banks to deposit cash to long queues at ATMs to withdraw money, the country has seen it all.

ATM is mainly used for withdrawing money and is used by many, but a very less number of people use ATMs to deposit cash. Most people are not aware of how to deposit cash in the ATM, and some people don’t know that depositing money at the ATM is possible. Mobile banking is very commonly used, but that cannot be used for depositing cash, and so one has to visit a bank or ATM to deposit money.

Important note – Not all ATMs accept deposits, and not all deposit-enabled ATMs will work with your account.

The ATM may require you to deposit the cash in an envelope which you’ll insert into a deposit slot. If that’s the case, you may be required to fill out certain information on the envelope. You can transfer money between your Bank of America accounts once you have linked these accounts to your ATM/debit card for ATM access. Visit your local financial center or contact customer service for assistance linking or unlinking your accounts. Once accounts are linked, select Make transfer from the ATM main menu, and then simply select the account from which you want to transfer money.

One common question that arises for first-time depositors is that – Can I deposit cash in any ATM? The answer to this is no. You cannot make deposits to another bank’s ATM. If you don’t have an account at a given bank, you can only make withdrawals (for an extra fee), but you can’t make deposits.

Let us learn how to deposit cash at an ATM stepwise –

There are two methods through which you can deposit cash in the ATM.

- Using ATM card

- Using account number

source: juridipedia.com

Below are the steps on how to deposit cash in ATM using ATM card –

1. Firstly confirm if you can deposit in that particular ATM –

While many bank ATMs allow withdrawals from non-customers (often for a fee), you’ll typically need to use your own bank’s ATM system to make deposits.

2. Insert a debit card and enter a PIN for validation.

This security step acts like a password for accessing your funds.

3. Select account type (Saving or Current) –

If you have multiple savings or current accounts, the ATM will ask where you would like your cash to go.

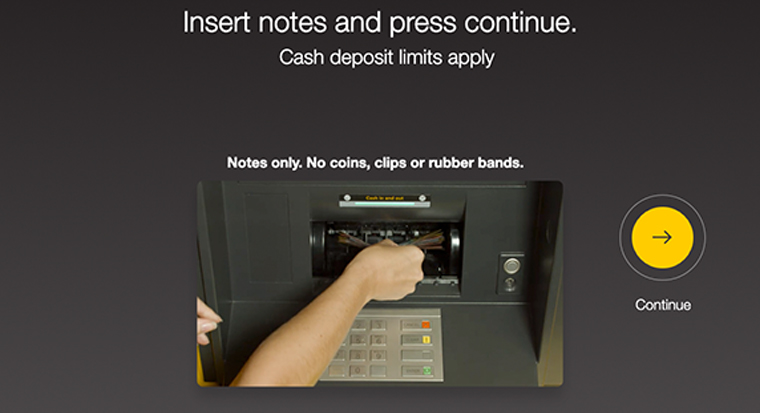

4. Place the money in the cash deposit box and click “Continue.”

Please check if the money deposited is in the denomination as per bank rules. The Cash deposit machine (CDM) accepts Rs 100, Rs 500 and Rs2000 denominations only

5. The machine will sort out the cash and will show denomination-wise amounts to be deposited.

Once cash received the machine will check and sort the money and show the exact number of notes of each denomination

6. If correct, click “Deposit.”

Once you read the denominations and amount tallies with the amount you have deposited, then click on ‘Deposit.’

7. The amount will be deposited.

The amount will get deposited in your account

8. Receipts will be generated.

Check the receipt thoroughly of the amount you have deposited

9. Confirm that your session has ended before you walk away from the machine.

When done, please check if the session has ended, and the main screen page is reflecting again.

source: gannett-cdn.com

Below are the steps on how to deposit cash in ATM using Account number –

1.Walk-in to the nearest ATM and check for the option ‘cardless deposit’ on the Cash deposit machine (CDM) and select it.

2. Click “Cash deposit without a card.”

CDM will show two options – first with ATM card and 2nd with a bank account, click on 2nd option

3.Enter the account number in which you wish to deposit cash.

Enter your 15 digit account number in which you wish to deposit the cash.

Depositing Cash Into Atm

4.The machine will display the name of the account holder.

Check if the name of the account holder displaying on the screen is correct as per the account number mentioned.

5. If correct, click “Enter.”

6.Place the money in the cash deposit box and click “Continue.”

Please check if the money deposited is in the denomination as per bank rules. The Cash deposit machine (CDM) accepts Rs 100, Rs 500 and Rs2000 denominations only

7.The machine will sort the cash and will show the summary.

Once cash received the machine will check and sort the money and show the exact number of notes of each denomination

8.If correct, click “Deposit.”

Once you read the denominations and amount tallies with the amount you have deposited, then click on ‘Deposit.’

9.The amount will be deposited.

The amount will get deposited in your account

10. Receipts will be generated.

Check the receipt thoroughly of the amount you have deposited

11. Confirm that your session has ended before you walk away from the machine

When done, please check if the course has been ended and the main screen page is reflecting again

Some tips before depositing cash in ATM –

source: tosshub.com

Make sure the environment around you is safe, and not too many people are there around. If someone is standing nearby or is watching you, then you must not take cash out at that moment.

You must follow on-screen instructions and check if you can make multiple deposit items at once. The instructions will guide you if you need to insert deposits one-by-one. Once the process is complete, review the amount and make sure that the deposit is finished correctly. Check if any corrections are needed. After confirming, take the receipt and check the deposit details. Verify the completion of your session and that your account details are not accessible anymore. Check the main screen is appearing again, and no other details are visible.

Essential Tips: Remember, the machine times your deposit transaction. If you are taking too long to feed the money into the machine, your transaction will be timed out. It would be better if you bring all documents at once to avoid unnecessary chaos while depositing the cash.

CDM is a blessing at times, as one can deposit cash at any time, even after the banking hours. But at the same time, there are some problems with these CDM machines at times.

Below are certain problems faced with depositing cash at an ATM:

1. Errors

Sometimes, ATMs make mistakes and take too long to search for the account details and end up showing or depositing in other accounts, and researching transactions can take multiple days or more.

2. Safety

Nowadays, many incidents of robbery take place while a person is depositing cash in an ATM cash deposit machine and even stealing your card information and PIN. Check your ATM’s location, go to a well-lit, and well guarded ATM. If you make deposits in the same ATM regularly, then you need to change regular transactions so that nobody can learn your patterns.

3. Access to Funds

Depositing, with the help of a bank employee, will be the easiest and quickest way to use funds from a cheque.

In case the ATM eats your deposit without crediting the amount or serving a receipt, then you should immediately alert your bank or credit union. They will help you investigate further. The bank will check the transaction and update you about how many business days it will take to reflect the transaction in your account, and they will contact you as soon as the error is corrected. If it was a technical error, then the bank will help you credit the deposit. But you must verify that the bank is taking necessary steps to rectify the error and don’t forget to save details of the deposit and note time of the transaction as a proof to show to the bank.

Banking systems are improving, and so such facilities of ATM cash deposits are being used in today’s world. Initially, the process can be tricky for some people, but eventually, you will understand the drill. It is more convenient for people to deposit money in the ATM instead of following the traditional banking system. For more information, visit Financeshed.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Manage your Chase ATM experience

Chase ATMs work with your mobile wallet

- Overview

- ATM Enhancements

- FAQs

Get cash at select Chase ATMs

Manage your money and your accounts at over 16,000 ATMs.

Skip the lines and pay your Chase credit card, mortgage or home equity bill with cash or directly from your Chase checking or savings account.

Watch video about paying Chase cards at select ATMs

Choose your account, amount and receipt options in the Chase Mobile app® then stop by any Chase ATM to complete your transaction.

Watch video about scheduling withdrawal

Set your preferences and customize your experience while at the ATM. Select which accounts to display, receipt options, Quick cash amount, and preferred bill denominations under the preferences tab.

Watch video about personalizing the ATM experience

See how-to videos for ATM banking

No debit card? No problem.

Now you can use your mobile wallet at Chase ATMs and get cash quickly and securely.

Q&A

Answers to the most common questions

How do I find the nearest ATM?

ExpandUse our locator to find an ATM or Chase branch.

What is cardless ATM access?

ExpandCardless ATM access allows customers to access Chase ATMs using an eligible Chase debit or Liquid card that has been loaded into an Apple Pay®, Google Pay™ or Samsung Pay mobile wallet. Once you have successfully loaded your card into your mobile wallet, you no longer need to have your physical card to make transactions at Chase ATMs.

Learn more about Cardless ATMs

Where are Chase ATMs with cardless access located?

ExpandCardless ATM access is currently available on Chase ATMs where you see this Cardless symbol:

Deposit Money At Atm Machine

How soon will my checks clear after depositing them at the ATM?

ExpandGenerally, for most accounts, you may withdraw funds the next business day after the business day you deposit them whether at the ATM or at a teller. But in some cases you may not be able to immediately withdraw or write checks against deposited funds. If funds from a deposit become Available and you can withdraw funds, that does not mean the check or other item you've deposited is Good has Cleared or has been paid by the paying bank. It's possible that the item will be returned unpaid months after we've made the funds available to you and you've withdrawn them. No one, including our employees, can guarantee you that a check or that or other item will not be returned. See the Product Disclosure Agreement for additional information.

Can I deposit checks 24/7?

ExpandYou can make check and cash deposits at virtually any Chase ATM 24 hours a day, 7 days a week. Use our locator to find an ATM or Chase branch.

How do I get assistance if I am depositing checks at an ATM after branch hours and need help?

ExpandPlease call the Chase Customer Service number that is printed on the ATMs.

Can I set up my personal preferences for the ATM?

ExpandYes, with Chase ATM QuickChoice®, Chase ATM's can save you time by remembering exactly how much money you usually like to withdraw, what language you prefer and if you want a receipt printed or sent to your email.

You can preset your:

- Language preference. Select the language you want to use for your future ATM visits and we'll remember it next time.

- Receipt preferences. Choose whether you want us to 'Always Print,' 'Never Print,' or 'Always Prompt' for a receipt.

See how to set your preferences

What is the maximum amount I can withdraw from an ATM using my debit card?

ExpandThere are daily dollar limits for ATM withdrawals that were provided to you when you received your Debit Card. If you have any questions, please contact us.

How many checks can I deposit at the ATM at one time?

ExpandConveniently deposit cash and up to 30 checks.

What else can I do at the ATM?

Besides Depositing cash and checks and making withdrawals, you can also make transfers, view your balances, see your recent transactions and you will soon be able to make payments to your credit card.

Have more questions?

ExpandContact us or schedule a meeting with a banker.