Current Deposit Account

Current and Deposit Accounts. QNB offers a range of account types to meet the business and financial requirments of our corporate clients: Fixed Deposit Accounts: Cash deposits placed with QNB for a fixed term, paying competitive interest rates and including conditional access to funds. A current account, also known as financial account is a type of deposit account maintained by individuals who carry out significantly higher number of transactions with banks on a regular basis. It is created by the bank on request of the applicant and is made available for frequent or immediate access.

Current bank account is opened by businessmen who have a higher number of regular transactions with the bank. It includes deposits, withdrawals, and contra transactions. It is also known as Demand Deposit Account.

Current account can be opened in co-operative bank and commercial bank. In current account, amount can be deposited and withdrawn at any time without giving any notice. It is also suitable for making payments to creditors by using cheques. Cheques received from customers can be deposited in this account for collection.

In India, current account can be opened by depositing Rs.5000 to Rs. 25,000. The customers are allowed to withdraw the amount with cheques, and they usually do not get any interest. Generally, current account holders do not get any interest on their balance lying in current account with the bank.

Current account holder get one important advantage of overdraft facility.

Features of Current Bank Account

The main features of current account are as follows:-

- Current bank accounts are operated to run a business.

- It is a non-interest bearing bank account.

- It needs a higher minimum balance to be maintained as compared to the savings account.

- Penalty is charged if minimum balance is not maintained in the current account.

- It charges interest on the short-term funds borrowed from the bank.

- It is of a continuing nature as there is no fixed period to hold a current account.

- It does not promote saving habits with its account holders.

- Banker requires KYC (Know your Customers) norms to be completed before opening a current account.

- The main objective of current bank account is to enable the businessmen to conduct their business transactions smoothly.

- There is no restriction on the number and amount of deposits.

- There is also no restriction on the number and amount of withdrawals made, as long as the current account holder has funds in his bank account.

- Generally, bank does not pay any interest on current account. Nowadays, some banks do pay interest on current accounts.

Advantage of Current Bank Account

The advantages of current account are as follows:-

- Current account is mainly opened for businessmen such as proprietors, partnership firms, public and private companies, trust, association of persons, etc. that has a large number of daily banking transactions, i.e. receipts and/or payments.

- It enables businessmen to carry out their business transactions properly and promptly.

- The businessmen can withdraw from their current accounts without any limit, subject to banking cash transaction tax, if any levied by the government.

- Home branch is that location where one opens his bank account. There are no restrictions on deposits made in the current account opened in a home branch of a bank. However, the current account holder can deposit the cash from any other branch of a bank other than the home branch by paying a nominal charge as applicable.

- It helps businessmen to make a direct payment to their creditors by issuing cheques, demand-drafts or pay-orders, etc.

- It enables a bank to collect money on behalf of its customers and credits the same in their customers' current accounts.

- It enables the current account holder to obtain overdraft (short-term borrowing) facility.

- The creditors of the account holder can get credit-worthiness information of the account holder through inter-bank connection.

- It facilitates the industrial progress of the country. Without its help, businessmen would face difficulties in running their businesses.

- It has the facilities of Internet-banking and mobile-banking to carry out important business transactions with ease and quickly.

- It also provides various other advantages (benefits) such as:

- Deposit and withdrawal of money (cash) at any location.

- Multi-location funds transfer,

- Electronic funds transfer,

- Periodical (monthly, quarterly or yearly) e-mail or download of bank statements in various formats like '.XLS', '.TXT', '.PDF', etc.

- Support from customer care executives

Source:Portal Content Team

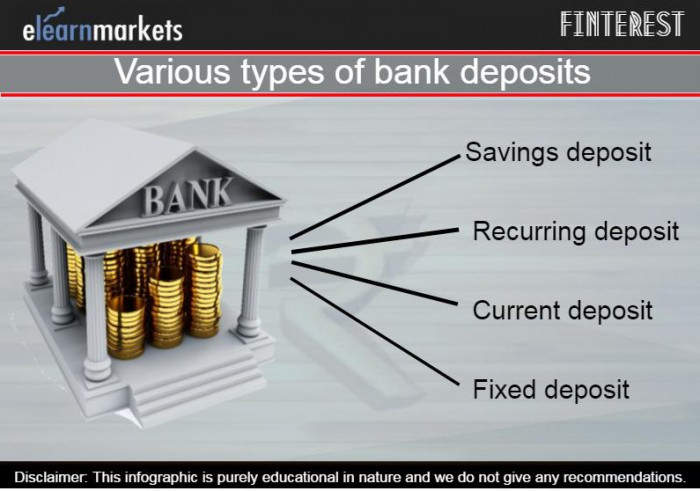

Deposits of banks are broadly classified into three categories: Demand deposit, Term deposits and Flexi deposit or also known as Hybrid deposit.

Deposit Account Blog

1. Demand Deposits Account

Demand deposits are repayable on demand by the customers. Current account deposits, Savings bank deposits and Call deposits are the examples of demand deposits. These deposits are repayable on demand by the customers. The amount deposited on these accounts to be released upon the request of customer without any delay.

1.1 Current Accounts

Current accounts form a large portion of demand deposits of a bank. It can be opened by Individuals, Business entities (firms, company), Institutions, Government bodies / departments, Societies, Liquidators, Receivers, and Trusts.

The main features of current accounts

- The current account does not have restrictions on the number and amount of withdrawals / deposits. Hence this account is maintained by all businesses with one or more banks.

- Withdrawals are permitted by cheques in favour of self and also in favour of other parties.

- The payees of cheques can endorse the cheques in favour of third parties who can receive payment in cash at the drawee bank branch or through their bank account via clearing or collection.

- All current accounts are non-interest bearing and banks are not allowed to pay any interest or brokerage in any form to the current account holders.

- Cheque book facility is provided to each current account holder and bank undertakes to honour all cheques drawn correctly so long as there is sufficient balance to the credit of the account.

- Overdrafts facility may be available in case of an emergency cash requirement (Overdraft is a facility whereby banks honour cheques drawn by current account customers even when the balance in the account is less than the amount of the cheques). This can be a temporary one but Regular Overdraft (permanent) facility is granted as per prior arrangement made by the account holder with the bank.

- In such cases the bank would honour cheques drawn in excess of the credit balance but not exceeding the overdraft limit. Every over draft occurrences, bank would charge agreed interest on the overdraft portion of drawings.

- The account holder periodically gets statements of accounts from the bank branch for reconciliation and record

- The statement of account would show date-wise the entire debit and credit transactions and balances, as recorded in the bank’s ledger account of the customer.

1.2 Savings Bank Account (SB Accounts)

Savings bank accounts are intended for keeping savings of individuals and small businesses for meeting their future money needs. Interest is given by banks on these accounts with a view to encourage saving habit in the community. It can be opened by Individuals, guardians (on behalf of their minor children / wards), Clubs, Associations, Trusts.

There are two types of Savings Bank Accounts available in India. They are: Cheque book facility accounts and Non-cheque book facility accounts. (Some other variants also can be noted such as zero balance and minimum balance type).

- Cheque book facility accounts - Withdrawals are permitted by cheques drawn in favour of self or other parties; The payees of cheques can receive payment in cash at the drawee bank branch or through their bank account via clearing or collection; The account holder may also withdraw cash by filling up withdrawal form.

- Non-cheque book facility accounts - Withdrawals are permitted to the account holders only at the drawee bank branch by filling up a withdrawal form or letter accompanied with the account passbook and in such accounts third parties cannot receive payments.

Current Deposit Account Definition

Main Features of Savings Bank Accounts

- Withdrawals are permitted on demand of the account holder by presentation of cheques or withdrawal form / letter. However, cash withdrawals in excess of the specified amount per transaction / day (the amount varies from bank to bank) require prior notice to the bank branch.

- Banks put certain restrictions on the number of withdrawals as per - Month / quarter, Amount of withdrawal per day, Minimum balance to be maintained in the account on all days etc.

- Banks levy fee / penalty for violations of these rules. These rules are different for different banks, as decided by their Board / Top Management. The rationale of these restrictions is that the savings bank account should not be used like a current account, as it is primarily intended for keeping and accumulating the savings.

- The bank pays interest on the minimum balance maintained in the account during the specified period of every month.

- Interest on savings bank account continues to be regulated by the Reserve Bank of India. It is 3.50% per annum and all commercial banks have to pay this rate on savings bank accounts. No overdraft in excess of the credit balance in savings bank account is permitted, as there cannot be any debit balance in savings accounts.

- Most banks provide every savings bank account holder a passbook. This passbook is regularly updated with information maintained by the bank in the customer’s ledger account in the form of chronological order of Debit transactions, Credit transactions, and Credit balances.

2. Term Deposits Account

Term deposits are repayable on maturity dates as agreed between the customers and the banker. They are: Fixed deposits and Recurring deposits. It can also be withdrawn by compromising of the interest rate or penalty deductions from the deposit, if depositor required to the amount prior maturity.

2.1 Fixed Deposits

Fixed deposits are repayable on a prefixed maturity date. The amount repayable is: The principal amount and Agreed interest rate for the period. No operations are allowed to the customer against the deposit, as is permitted in demand deposits.

Main Features of Fixed Deposits

- Fixed deposits are accepted for specified periods at specified interest rates as mutually agreed between the depositor and the banker at the time of opening the account. Since the interest rate on the deposit becomes contractual, it cannot be altered even though the interest rate changes - upward or downward - during the period of the deposit.

- Banks offer varying interest rates for different maturities as decided by their Board.

- The maturity-wise interest rates in a bank will, however, be uniform for all customers subject to two exception.

- High value deposits above certain cut-off valu.

- Deposits of senior citizens (above the specified age normally 60 years) may be offered higher interest rate.

- Minimum period of fixed deposit is 7 days and maximum period for which a bank can accept a deposit presently is 10 years.

- Those term deposits which are held for periods of 6 months and less are called Short Term Deposits or Short Deposits.

- The deposit receipt issued by the bank branch accepting the fixed deposit mentioning the depositor’s Name, Principal amount, Maturity period, Interest rate, Dates of the deposit and its maturity.

- The deposit receipt is not a negotiable instrument nor is it transferable, like a cheque.

- Many banks prepay fixed deposits, at their discretion, to accommodate customers request for meeting emergent expenses. In such cases, interest is paid for the period actually elapsed and at rate generally1% lower than the rate applicable to the period elapsed.

- Banks also may grant overdraft / loan against the security of their fixed deposits to meet emergent liquidity requirements of the customers. The interest on such facility will be 1% to 2% higher than the interest rate on the fixed deposit.

- Banks are required to calculate and credit the interest payable on the deposits on a quarterly basis. However, for the convenience of the depositors banks pay interest at different desired intervals namely Monthly / Quarterly / Half yearly / Yearly. Banks give different names to such deposits for easy identification both by the bank and also the depositor.

2.2 Recurring Deposits

The customer deposits a fixed sum into the account at pre-fixed frequency (generally monthly / quarterly) for a specified period (12 months to 120 months). The interest rate payable on recurring deposits is pre-fixed and it is generally a little lower than the fixed deposit rate for the same period. The total amount deposited along with the interest is repaid on the maturity date. However, depositor may be allowed to take advance against the deposits or to have the deposit pre-paid before the maturity, for meeting emergent expenses. In the latter case, the interest rate payable by the bank would be lower than the contracted rate and some penalty would also be charged.

3. Flexi Deposits or Hybrid Deposits

Hybrid deposits or flexi deposits which combine the features of demand and term deposits. These deposits are introduced in recent times by some banks to meet customers’ financial needs and convenience and are known by different names in different banks. These deposits are a combination of demand and fixed deposits for meeting customer’s financial needs in a flexible manner. Hence these are hybrid deposits or flexi-deposits. For example: Quantum Deposit Scheme of ICICI Bank and Multi Option Deposit Scheme (MODS) of SBI. The flexi deposits show a fusion of demand and fixed deposits.

3.1 Main Features of Flexi Deposits

- Only one savings / current account is opened and the term deposits issued under the scheme are only on the bank’s books as no term deposit receipts are issued to the customer.

- Once deposits in savings/current account cross a pre-agreed level, such surplus amount is automatically transferred to term deposit account of a predetermined maturity (usually one year) in the customer’s name for higher interest earning.

3.2 Main advantages of the flexi-deposits

- Advantage of convenience: The customer opens only one account (savings or current) under the scheme and need not come to the bank branch each time for opening term deposit accounts or for pre-paying/ breaking term deposit for meeting the shortfall in the savings/current account.

- Advantage of higher interest earning: The customer earns higher interest on his surplus funds than is possible when he opens two separate accounts- savings and term deposits.