Chase Bank Direct Deposit

Get your personalized pre-filled direct deposit form. Sign in to chase.com or the Chase Mobile ® app. Choose the checking account you want to receive your direct deposit; Navigate to Account Services by scrolling up in the mobile app or in the drop down menu on chase.com; Click or tap on Setup direct deposit.

The Chase bank direct deposit form is a standard and legal form that becomes effective once it is signed. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account of your choosing when it is time for the Employer to pay you. The rate and frequency of these Deposits will be strictly up to you and your Employer. Additionally, your Employer may also have their own procedures set in place to set up Direct Deposit Payments. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

- With the Chase Total Checking bonus, however, all you have to do is open an account and set up direct deposit to have your paycheck, pension or government-issued benefits deposited into your account to earn the $200 bonus. The Chase Total Checking bonus promotion ends on April 14, 2021, but don’t worry if you miss out on this run.

- To receive the bonus: 1) Open a new Chase Total Checking ® account, which is subject to approval; AND 2) Have your direct deposit made to this account within 90 days of coupon enrollment. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the.

Step 1 – Download the document from the button labeled “PDF” on the right side of this page. When you are ready, you may either open it to enter information or print it to enter information.

Step 2 – Read the information on the left side of the page then, when you are ready, report the Account Holder/Recipient Name on the blank line labeled “Customer Name.” Below this, use the “Address” line to enter the Chase Account Holder’s Street Address. On the next line, report the City, State, and Zip Code associated with the Chase Account Holder’s Street Address.

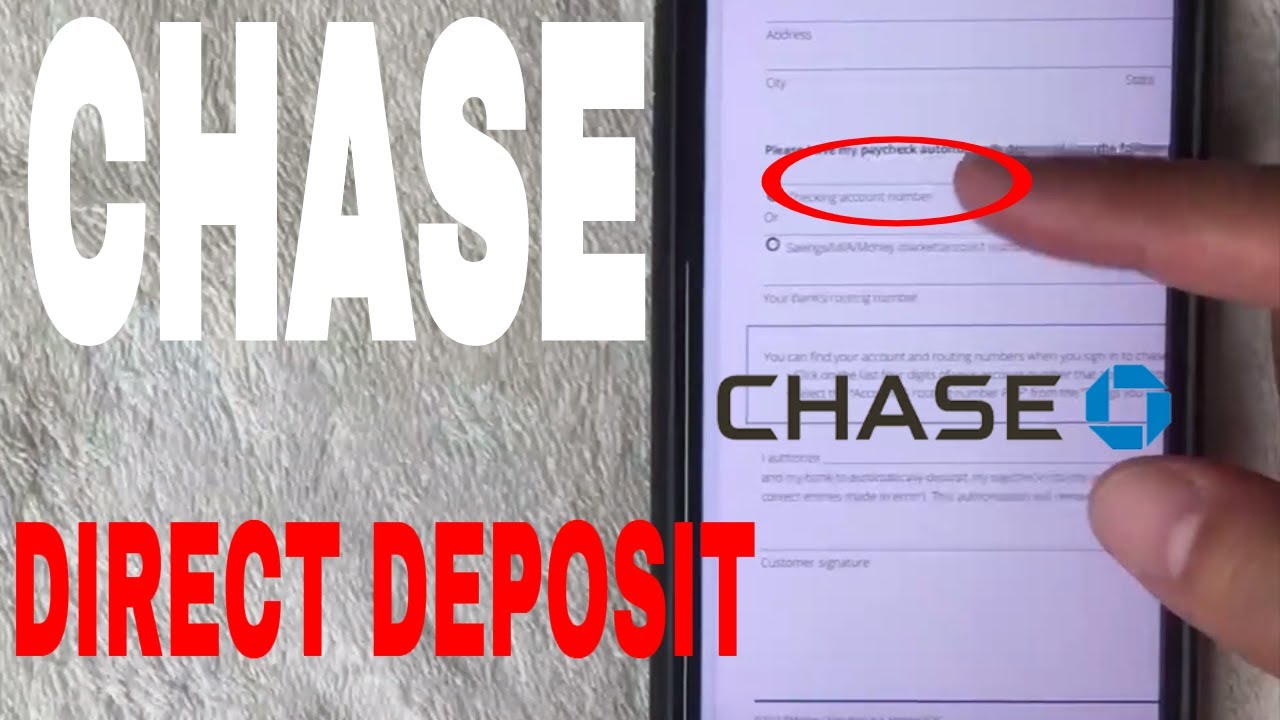

Step 3 – Next you must define the Type of Account you would like your compensation to be directly deposited to. If this will be a Checking Account, then mark the check box labeled “Checking Account Number” and enter your Account Number on the blank line above these words. If this is a Savings Account, then check the box labeled “Savings/MIA/Money Market Account Number” and enter your Account Number on the blank line just above these words. Only one of these boxes may be checked and the Account Number must be present on the blank line associated with that check box.

Step 4 – Report your Chase Bank Branch’s Routing Number on the blank line labeled “Bank’s Routing Number.” If you are unsure, you may find the Routing Number on your personal check. It is the nine digit number on the bottom left. Otherwise contact your branch directly for this number.

Chase Bank Direct Deposit Info

Step 5 – On the blank line in the statement beginning with the words “I authorize…,” enter the Name of the Employer or Paying Entity that you are allowing to make regular deposits into the Account defined in Step 3.

Chase Bank Direct Deposit Form

Step 6 – Sign your Name on the line labeled “Customer Signature” then, enter the Signing Date just above the word “Date.”

Free Chase Deposit Slip Printable

Step 7 – Submit this form to the Payroll Department in your Employer’s Company. Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.